A rise in inflation that has many British citizens feeling the pain in their wallets has been plaguing the country in recent months. It is essential to understand the reasons why the costs of basic products and services continue to increase. In this article, we will examine the main factors driving this and their effects on the economy and consumers.

But before we begin, it is important to understand what inflation means. When the prices of goods and services rise steadily over time, it’s called inflation. It reduces the purchasing power of money, raises living expenses, and perhaps affects numerous economic factors, such as interest rates and consumer spending.

Jump to

- Why does the UK inflation rate seem so high?

- What does inflation mean?

- Measuring the inflation rate in the UK: how is it determined?

- Inflation: why is it so high?

- When it comes to fighting inflation, how does raising interest rates help?

- How soon will inflation subside?

Why does the UK inflation rate seem so high?

Credit: International Private Banker

Credit: International Private Banker

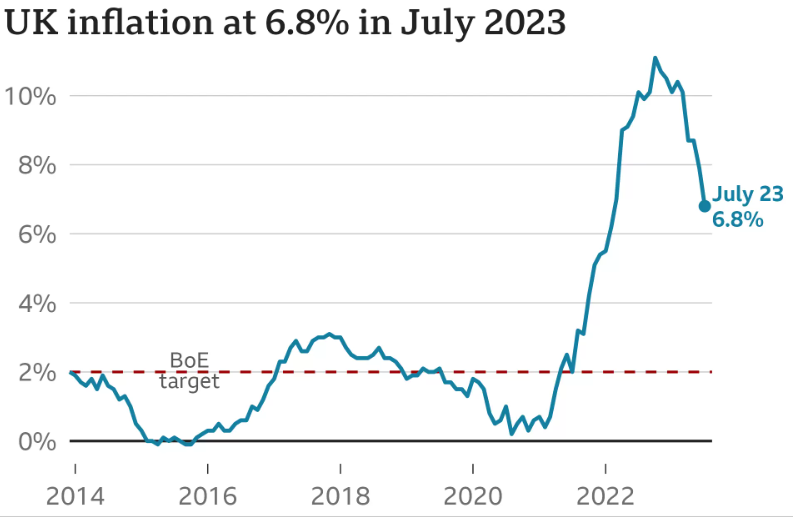

This year, up to July, the growth rate of prices decreased from 7.9% in June to 6.8%. Although it has decreased, inflation for foods such as milk, bread and cereals is still high, at 14.9%.

Inflation measured by the Consumer Price Index (CPI) is expected to be 6.8% in the year to July 2023, up from 7.9% the previous month, according to the most recent report from the Bureau of Statistics. National (ONS).

The Bank of England raised interest rates 14 times, to 5.25%, to help moderate price increases.

What does inflation mean?

A prolonged increase in the average price of goods and services over time in an economy is called inflation in economics. When there is inflation, a country’s currency (such as the pound in the UK or the dollar in the US) has less purchasing power per unit than before. In other words, inflation reduces the value of money as a medium of exchange.

The amount that prices have increased over a given period, usually a year, is indicated by inflation, usually expressed as an annual percentage rate. It is calculated using a variety of price indices, including the Consumer Price Index (CPI) and the Producer Price Index (PPI), which monitor changes in the costs of a selection of goods and services that consumers typically purchase. .

If a bottle of milk costs £1 today but costs £1.05 tomorrow, milk inflation is 5% per year.

Measuring the inflation rate in the UK: how is it determined?

Credit: National Statistics

Credit: National Statistics

The Office for National Statistics (ONS) tracks the costs of hundreds of common items in a fictitious “basket of goods”. The shopping cart is often modified to follow market trends; newer additions include frozen berries and the removal of alcoholic beverages.

The monthly inflation rate shows how much these costs have increased since the same time last year. The Consumer Price Index (CPI) is the main “headline” measure of inflation. However, it can be calculated in several different ways.

The CPI fell from 7.9% in June to 6.8% in the year to July.

Inflation: why is it so high?

Previous Bank of England predictions had indicated that UK inflation rates would moderate, falling to just over 5% in the fourth quarter of 2023 and below its target of 2% in the first quarter of 2025.

However, inflation rates have skyrocketed due to major economy-wide price increases, energy subsidies and the troubled post-pandemic UK job market. Following the large-scale Russian invasion of the Ukraine in February 2022, which sent natural gas prices skyrocketing across Europe, inflation in the UK also rose sharply.

The Office for National Statistics reported that core inflation unexpectedly rose to 7.1 percent from 6.8 percent, its highest level since March 1992. Core inflation is a measure that excludes volatile food prices, energy, alcohol and tobacco, which the Bank of England considers fair. indicator of underlying price pressures.

Services inflation, a key indicator of underlying pressures strongly driven by rapid wage growth and the challenging post-pandemic British labor market, also hit its highest level since 1992, at 7.4 percent.

“The cost of air tickets rose more than a year ago and is at a higher level than usual in May,” said Grant Fitzner, chief economist at the Office for National Statistics.

However, the food and beverage price inflation rate decreased from 19% in April to 18.3%. Meanwhile, producer price inflation declined to 2.9 percent in the year to May, from a 5.2 percent increase in April, much more dramatically than economists had anticipated.

Credit: Bank of England

Credit: Bank of England

When it comes to fighting inflation, how does raising interest rates help?

Although the Bank of England aims to keep inflation at 2%, the current rate is much higher. Interest rates generally rise in reaction to rising inflation. Due to the higher cost of borrowing, certain borrowers who have mortgages may experience an increase in their monthly payments. Additionally, some savings rates increase.

People buy fewer things when they have less money to spend, which decreases demand for raw materials and slows price increases. Businesses may also reduce the number of employees as a result of borrowing less money.

The Bank of England raised interest rates in June for the fourteenth consecutive time, taking the reference rate to 5.25%.

How soon will inflation subside?

Credit: Reuters

Credit: Reuters

Lower inflation does not imply lower prices. Simply put, they ascend more slowly. Instead of the 4% it had forecast, the Bank of England expects inflation to reach 5% by the end of 2023.

People “must trust that their hard-earned money retains its value,” according to bank governor Andrew Bailey. It is therefore “crucial that we carry out the work” and bring price increases back to the 2% target.

However, he acknowledged that price inflation was “tougher than initially anticipated.”

The Office for Budget Responsibility (OBR), which assesses the government’s economic strategies, had previously anticipated that inflation would return to 2.9% by the end of the year.

what do you think about it? Let us know in the comments.

For more trending stories, follow us on Telegram.

Categories: Trending

Source: vtt.edu.vn