Here we are going to talk about Gameberry FY23 as the public is searching for it on the internet. The public is surfing the internet to know more about the end of FY23 and they not only like to know the details about your income and profits as everyone is searching for them on the internet. Therefore, we have provided information about Gameberry’s FY23 end in this article for our readers. Not only that, we are also going to provide details about your income and earnings as the public searches for you on the internet. So, keep reading the article to know more.

Gameberry’s operating income increased

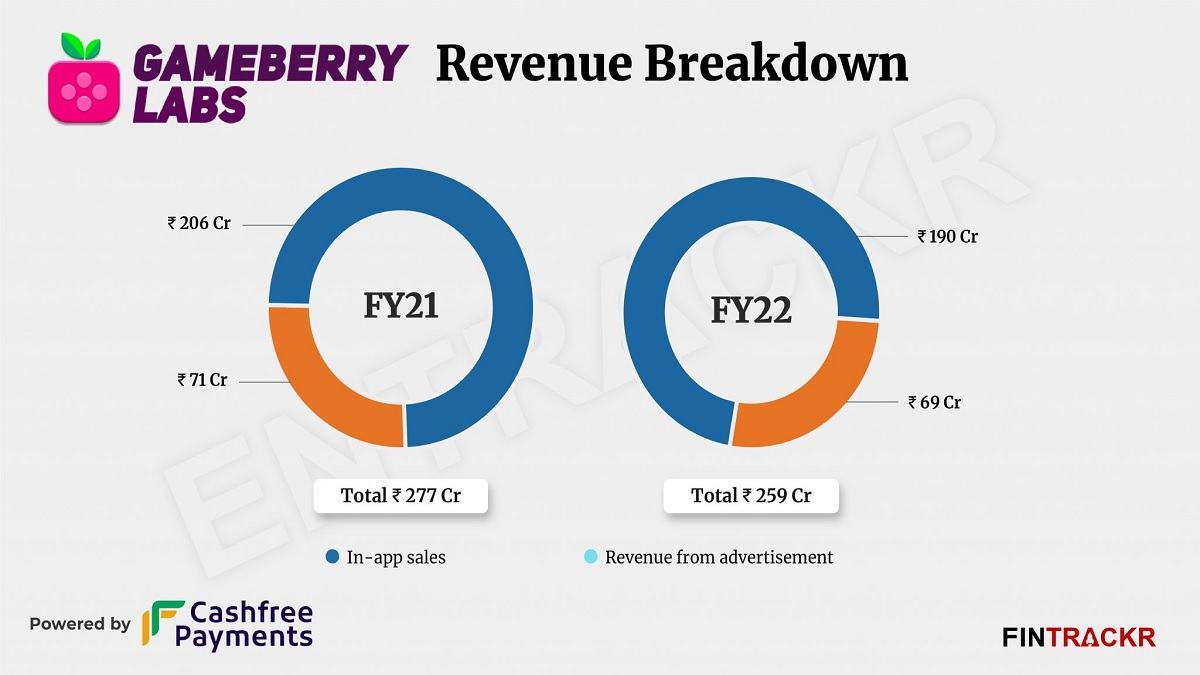

Self-funded game publisher Gameberry saw a significant expansion in size over the previous two fiscal years (FY22 and FY23), although revenue collections increased by only 13%. The company’s profits fell 65% in FY21 even though its scale had quadrupled thanks to a sharp increase in employee benefits and advertising expenses. According to Ahmad, Gameberry claims to have 22 million monthly active users (MAU) and between 60,000 and 70,000 monthly transactional users (MTU). In FY23, the company’s revenue reached Rs 314 million and declared a profit of Rs 65 million. With revenue of Rs 259 crore, Gameberry made a profit of Rs 93 crore in the previous fiscal year, FY22.

Compared to Rs 259 crore in FY22, Gameberry’s operating income rose 21.2% to Rs 314 crore in the fiscal year ended March 2023, according to the consolidated financial statement filed with the Business Registry. The company hosts three games: Parchisi Star, Ludo Star and Ludo Titan. The majority of Gameberry’s revenue comes from in-app purchases, which increased 29% over the course of the fiscal year. The company’s advertising revenue continued to grow unchanged in FY23. The Bengaluru-based company also made profits on non-operating financial assets (interest) totaling Rs 14.8 crore. Surprisingly, 99.8% of Gameberry’s operating income came from outside India.

According to TheKredible, Gameberry’s employee benefit costs increased dramatically 4.5 times during the fiscal year, from Rs 22.7 million in FY22 to Rs 102.7 million. Due to the absence of share-based employee payment of Rs 53.7 crore in FY22, there was a significant increase in employee expenses in FY23. platforms and payment facilitation rose 42% to Rs 71.5 crore in the fiscal year, while spending on advertising and promotion also increased. The company’s overall spend increased dramatically, rising from Rs 142 crore in FY22 to Rs 278 crore in FY23, an increase of 95.8%.

Categories: Biography

Source: vtt.edu.vn