HDFC Customer ID 2023: Every Indian customer has access to a wide range of banking options through HDFC Bank. Depending on the client’s requirements, bank accounts can be opened. Some people choose accounts because they can bank and withdraw money at any time. The applicant deposits the amount of his/her monthly income in the HDFC savings account as part of the service package.

Liquid accounts are savings accounts. The account earns interest, the account holder can withdraw his savings up to the set limit and you can access the money at any time through ATM, net banking, mobile banking and other methods. Through the debit card, you can take advantage of a variety of savings account offers. The applicant has the option of opening the savings account online or offline.

HDFC Customer ID 2023

The various banking options offered by HDFC Bank are available for Indian customers. The HDFC service package includes a savings account in which applicants can deposit a portion of their monthly income.

When a customer opens an investment account or some other type of registration with HDFC Bank, he or she is given an extraordinary distinctive test number. Each HDFC Customer ID 2023 is assigned a unique number that can be used for a variety of financial services. On the other hand, some customers may have trouble finding their Customer ID.

Highlights of Housing Development Finance Corporation Limited Bank

About HDFC Bank

The second largest private sector bank in India is HDFC Bank. HDFC Bank has the highest total assets, deposits, profits, branches, customers and employees, with its headquarters in Mumbai, Maharashtra. It maintains third position in terms of market capitalization. The bank was founded in 1994 with the aim of providing its clients with the highest quality services possible.

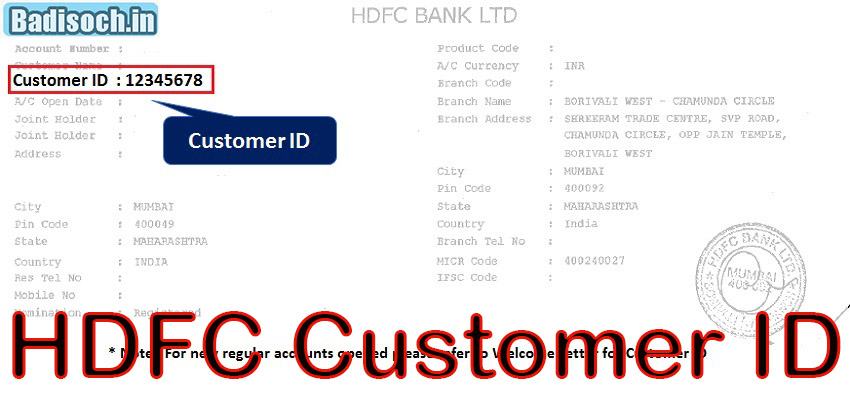

Every HDFC Bank customer who has a current or savings account is issued a unique identification number known as HDFC Customer ID. Bank employees use this unique number to identify the customer and their account. Additionally, to initiate any and all banking transactions, whether online, over the phone or in person, the customer will be required to enter their Customer ID.

Also Read: Outer Banks Season 3 Release Date

Find HDFC Customer ID using Welcome Kit

Every HDFC Bank customer receives a welcome package. It has been designed in a unique way by bank officials to help new customers get started with the bank. The kit contains details about the bank’s products and services, as well as useful tips on financial management. Your debit card, checkbook and savings book are included in the kit.

On the first page of the book and checkbook, the machine prints the customer ID. The Customer ID can be found on the first page of your passbook or checkbook by simply opening it.

Read More: Union Bank Balance Check Number 2023

How to Get HDFC Bank Customer ID

To get HDFC Bank Customer ID, you need to visit the official website of HDFC Bank. The bank’s website will provide you with all the necessary information about your account and transactions. You can also contact the bank’s customer service department by phone or online chat. Finally, you can obtain your account details by filling out a form and providing the necessary information. Read more Different ways below:

Online

- To reset your Customer ID, go to the HDFC Customer ID online banking login page at www.hdfcbank.com and select the “Forgot my Customer ID” option label.

- Please provide your current and verified cell phone number after that.

- You will need to provide your date of birth, your PAN card number, a response to the captcha and the country code. Please send your details so that the procedure can continue.

- A one-time password (OTP) will be sent to the phone number you have registered; You can continue once you have logged in.

- The customer ID will be displayed in the portal again.

- To access their customer identification information, NR customers must use their date of birth.

- One can obtain his or her Customer ID using the PAN information of the individual authorized signatory in the case of a firm, company, trust or other non-individual entity.

- To get a customer ID for HUF Karta, HUF PAN information must be used. If there are multiple customer IDs with the same updated information, they will not appear online.

See also: 2023 holidays

Mobile banking

- The mobile banking service on your device must be enabled.

- Logging in with the HDFC Mobile Banking App should be your first step.

- Navigate to “your profile” > “personal profile” in the menu after logging in.

- In the user settings, go to the “Profile” section and check the client ID.

Electronic statement

- Statements emailed to HDFC Customer ID’s preferred email addresses are your preferred method of communication.

- All persons who have access to a PDF electronic statement are subject to the same conditions.

- Your customer ID can be obtained quickly from your email. Open the attached email or PDF to view your Customer ID.

Checkbook

- On the first page of the HDFC bank check book, the customer ID is printed. The first page, which the customer must open, contains the account information.

See also: PNB balance check 2023

Passing by the bank

You can also obtain your Customer ID by going to any of the branches of the issuing bank. The steps to follow are the following:

- First, you have to physically visit an HDFC Bank branch.

- The second step is to request your customer ID from the bank staff.

- Third, to obtain your Customer ID, fill out the required information.

Passbook account statement

On the first page of the passbook, the customer ID of the HDFC bank account holder appears.

Welcome Letter

Upon opening a checking or savings account with HDFC Bank, account holders receive a welcome letter. The welcome letter sent to customers also mentions the customer ID.

Telephone banking

Customers with HDFC Bank accounts can also get the Customer ID by calling the bank’s Telephone Banking number in their city.

How to Check HDFC Bank Customer ID 2023 Online?

- Navigate to HDFC Internet Banking Login Page.

- Go to www.hdfcbank.com and select the “Forgot my customer ID” option.

- Enter your registration and operational mobile number below.

- Start with date of birth, country code (91), PAN card number and captcha.

- To continue, submit details.

- Enter the registration mobile number and click Continue to receive an OTP from the system.

- The customer ID will now be displayed on the portal screen.

SMS

To get your Customer ID on your mobile device, send an SMS with the subject “Register” followed by the words “Last 4 digits of Customer ID” and “Last 4 digits of Account Number” to the number 7308080808.

HDFC Customer ID 2023 FAQ

How many digits are in HDFC Bank Customer ID?

HDFC ledger number consists of 14 digits. It has a format that makes it easy to identify the type of product and the branch. For convenience, account numbers have a particular format for each bank.

What is 4 digit customer ID number in HDFC?

HDFC Bank provides a 4-digit number called “TIN” (Telephone Identification Number) to access the phone banking service. The term “Personal Identification Number” (or “PIN”) refers to a four-digit number provided by HDFC Bank for use with the ATM or associated debit card to access the ATM service.

What is my customer ID?

The unique number on your invoice that references your account is your Customer ID. You can use your Customer ID to: When working with a customer service representative, expedite your account requests and searches. Through your financial institution, you can set up online payments.

Categories: Trending

Source: vtt.edu.vn