Here in this article, we have brought interesting news for the central government employees. Every time the holiday season comes around, everyone gets excited. This season is something that everyone looks forward to as they will receive gifts and bonuses. And this year it seems that Modi Govt already announced the bonus. When the public found out about this, everyone started searching the internet for the eligibility for it and some other details. So keep reading the article to know more.

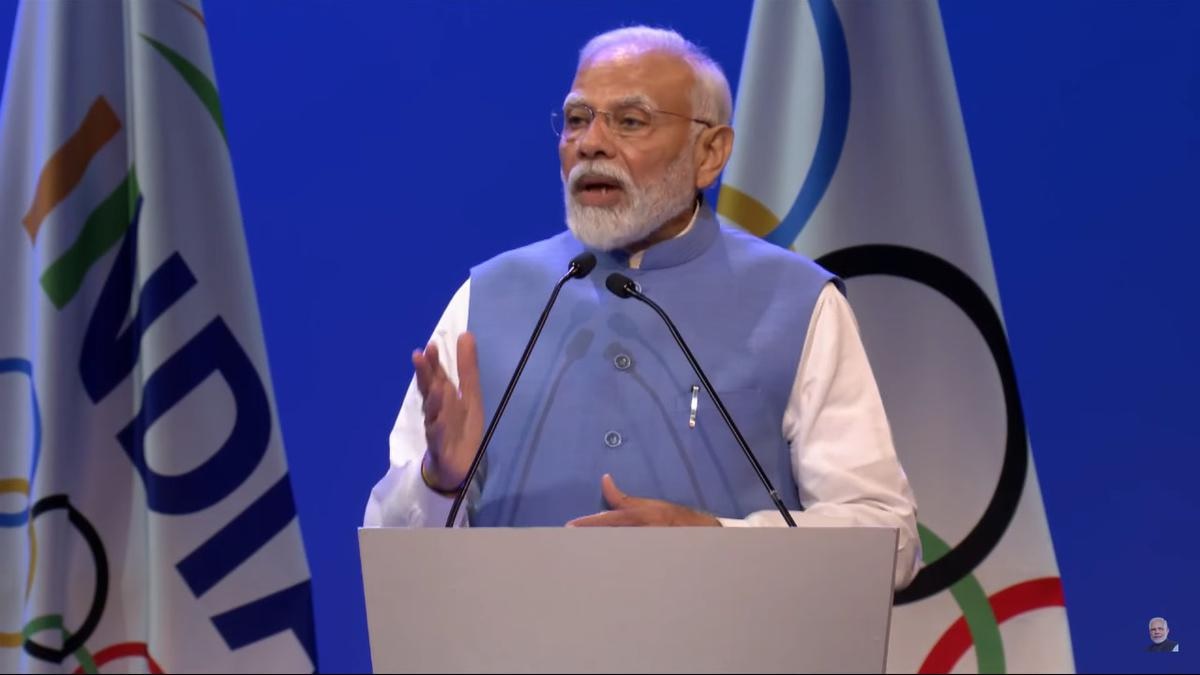

Modi govt announces bonuses ahead of Diwali

Ahead of Diwali, the Narendra Modi-led government announced incentives for paramilitary and rank-and-file officials not included in Group B. For 2022-2023, the Ministry of Finance has set a limit of 7,000 yen for the calculation of bonuses not linked to productivity for central government staff. A non-productivity bonus of 30 days’ salary has been given to all non-registered employees in Group B and all central government employees in Group C for the accounting year 2022-2023 who are not covered under any scheme bonus linked to productivity. , according to an office memo from the Expenditure Department of the Ministry of Finance.

To be eligible for payment under these orders, an employee must have been employed as of 3/31/2023 and have provided at least six months of continuous service during the 2022-2023 fiscal year. For a period of continuous service during the year ranging from six months to a full year, qualified employees will be eligible to receive prorated pay, and the period of eligibility will be measured in terms of the number of months of service. The calculation of the Non-PLB quantum will be based on the lower of the average emoluments or calculation ceiling. The average annual salary will be divided by the average number of days in a month, or 30.4, to determine No PLB for a day.

This will then be multiplied by the number of bonus days awarded. For example, if the calculation limit for monthly income is 7,000 and the actual average income is greater than 7,000, No PLB for thirty days would equal 7,000×30/30.4-6907.89. Casual workers who have worked in offices with a 6-day workweek for at least 240 days a year for three years or more or 206 days for three years or more will be eligible for this Non-PLB Payment. Rounding any payment made according to these instructions to the next rupee. According to the announcement of the Expenses Department of December 16, 2022, the expenses of this account will be debitable to the person responsible for the corresponding object. According to the government, the costs associated with this ad hoc incentive must be covered from the authorized budget allocation of the relevant ministries and departments for the current fiscal year.

Categories: Biography

Source: vtt.edu.vn