Check different details about PAN Aadhaar link last date. Check status, fees, payment, apply online from this article. Various details about PAN Aadhaar link last date. Status verification, fees, payment, online application and additional important details are included in this article.

PAN Aadhaar Link

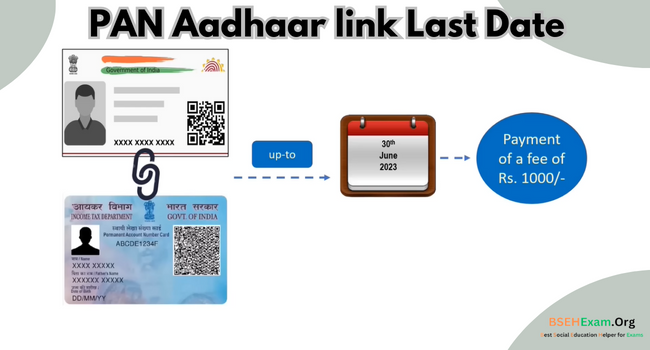

Linking PAN card with Aadhaar number is crucial for everyone. To prevent the PAN from becoming invalid, the Income Tax Department of India advises all citizens to link their Aadhaar with their PAN before the deadline.

HMA Agro Industries Ltd IPO

IKIO Lighting IPO GMP today

Kore Digital IPO GMP today

Meaning of the US Debt Ceiling

According to the official press release, as per the Income Tax Act, 1961, persons who hold a PAN as on July 1, 2017 and are eligible for an Aadhaar Number are required to notify the assigned authority of their Aadhaar by 31 July. March 2023, and pay the mandatory fee. If the linking is not done by June 30, the PAN will be marked as inoperative from July 1.

Link PAN Card with Aadhaar Card

The last date to link Aadhaar with PAN is June 30. It is suggested that all citizens link their Aadhaar with their PAN before June 30 to avoid negative consequences. All the necessary details and instructions regarding the linking procedure are available on the authorized e-filing web portal of the Income Tax Department of India.

By simply following the procedure, all citizens can easily link their Aadhaar with their PAN. Additionally, people who want to link their PAN and Aadhaar have to pay the mandatory fee of INR 1000.

PAN Aadhaar Link Status Check

If you are in doubt whether your Aadhaar is linked to your PAN or not, check the “Aadhaar Link Status” by visiting the authorized web portal of the Income Tax Department. It’s good if they are already linked. However, if they are not linked, you have to follow the procedure available on the Income Tax Department’s authorized e-filing web portal to link your Aadhaar and PAN.

To check PAN Aadhaar link status, follow these steps:

- Visit the authorized e-filing web portal of the Income Tax Department.

- In this web portal, click on “Link Aadhaar Status”.

- Submit the following details: PAN number and Aadhaar number.

- After this, click on “View Aadhaar link status”.

PAN Aadhaar Link Overview

| Name | PAN Aadhaar Link |

| Managed by | Income Tax Department |

| Last appointment | June 30th |

| Fee | 1000 rupees |

| Website | Incometax.gov.in/iec/foportal/ |

PAN Aadhaar Link Apply Online

Citizens whose PAN and Aadhaar are not linked can apply online for PAN Aadhaar link. There are three main steps in the PAN and Aadhaar linking process:

- Fee payment.

- Submit Aadhaar PAN linking request.

- Check PAN Aadhaar Link Status

For this important procedure, you can follow the following steps:

- fee payment

- Go to the authorized e-filing portal.

- Select the “Link Aadhaar” option.

- Submit Aadhaar and PAN number.

- Click “Continue paying.”

- Enter PAN/TAN and mobile number.

- Validate OTP and click continue.

- Select the evaluation year and choose the payment type (Others).

- After this, the challan will be generated.

- Select the payment method and pay through the bank’s website.

- Submit Aadhaar PAN linking request.

- Go to the authorized e-filing portal.

- Select the “Link Aadhaar” option.

- Enter your PAN number and Aadhaar number.

- Verify the details and click OK.

- Validate the OTP.

- After this, a linking request will be processed.

- Check the status.

- Go to the authorized e-filing portal.

- In this web portal, click on “Link Aadhaar Status”.

- Submit the following details: Aadhaar number and PAN number.

- Finally, the status will appear.

PAN Aadhaar Link Fees

The fee for linking PAN and Aadhaar is INR 1000. People who wish to link their PAN and Aadhaar have to pay the mandatory fee of INR 1000. This process will be done through the authorized e-filing web portal. After paying this fee, people can proceed to submit the linking request.

Energy comparison between India and China

The richest country in the world

The richest woman in the world

The most handsome man in the world.

The most beautiful woman in the world

PAN Aadhaar Payment Link

To make payment of INR 1000, follow these steps:

- Go to the authorized e-filing portal and select the “Aadhaar link”.

- Enter your PAN number and Aadhaar number, and continue.

- Enter PAN/TAN and mobile number and validate the OTP.

- Select the evaluation year and choose the payment type (Others).

- After this, the challan will be generated.

- Select the payment method and pay through the bank’s website.

Categories: Finance

Source: vtt.edu.vn