Harlem civil rights leader Al Sharpton on Saturday criticized one of New York’s most powerful unions for not directing its assets to minority-run investment funds.

During his weekly broadcast from his National Action Network headquarters in Harlem, Sharpton said he is concerned that influential local union 1199 Service Employees International Union is not investing in a way that reflects the diversity of its members, following an exclusive report from The Post about the hypocritical investment strategy.

“Across the board, unions and workers must do business in a way that reflects their politics, and I believe they will,” Sharpton said.

“But I’m going to make sure; Let’s sit with them. I think it’s important. I want the members of [NAN] and the members of the unions have the assurance that we are going to meet with [union presidents] in the next week or so. That is important.”

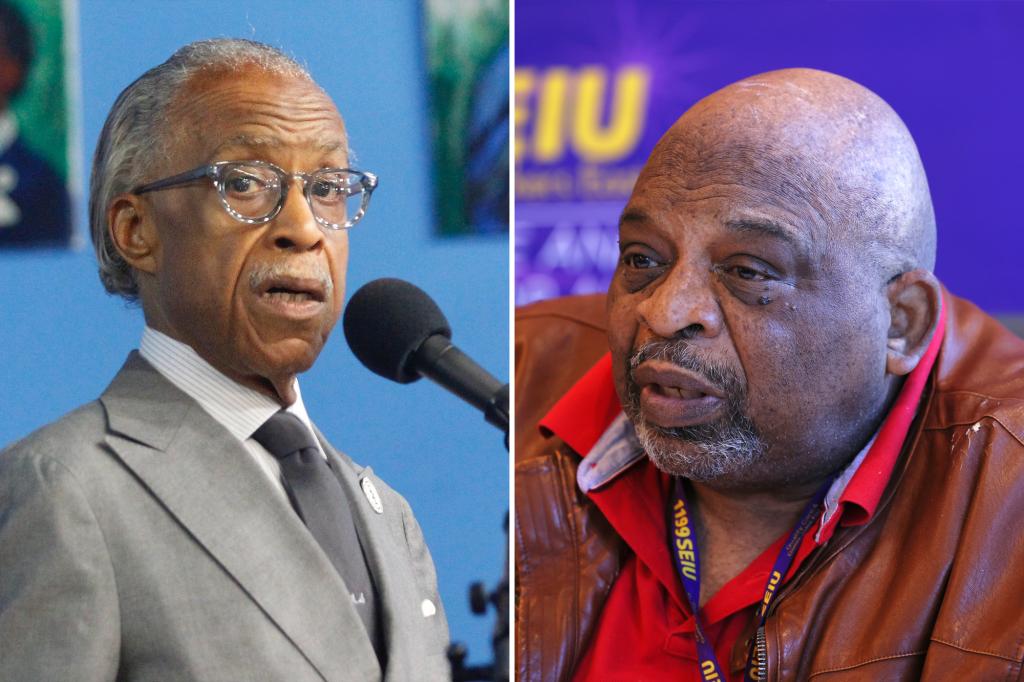

Harlem civil rights leader Al Sharpton sharply criticized one of New York’s most powerful unions for not directing its assets to minority-run investment funds.GNMiller/NYPost

Sharpton said he has already met with George Gresham, president of 1199 SEIU, and would continue talks with the powerful union, which operates in New York, New Jersey, Maryland, Massachusetts, Washington, D.C. and Florida.

His scathing comments come less than two days after The Post revealed that the union is failing to invest its funds in minority investment funds.

The SEIU union, which helped propel Bill de Blasio to two terms as the city’s mayor, has ignored lobbying pressure to invest some of its fortune in funds owned by women and managed by minorities.

Sharpton said he has already met with George Gresham (seen above), the president of 1199 SEIU, and would continue talks with the union. fake images

Sharpton said he has already met with George Gresham (seen above), the president of 1199 SEIU, and would continue talks with the union. fake images

“Across the board, unions and workers must do business in a way that reflects their politics, and I believe they will,” Sharpton said Saturday during his weekly broadcast from the headquarters of his National Action Network in Harlem.GNMiller /NYPost

“Across the board, unions and workers must do business in a way that reflects their politics, and I believe they will,” Sharpton said Saturday during his weekly broadcast from the headquarters of his National Action Network in Harlem.GNMiller /NYPost

The union, led since 2007 by Gresham, boasts that the majority of its 304,982 members are women, while it has focused its efforts on recruiting among minority communities.

But records inspected by The Post show that just one of those eight funds, the National Benefit Fund, has more than $17 billion invested in major Wall Street firms, including Blackstone and Apollo Global Management, Platinum Equity, based in Beverly Hills, and a number of other hedge funds and private equity funds.

“They’re really not supporting their diverse base in terms of their investment strategy,” said Robert Greene, chief executive of the National Association of Investment Companies, the industry association for diversely owned private equity firms and hedge funds. “They have invested very little in investment funds managed by minorities.”

Categories: Trending

Source: vtt.edu.vn