Everywhere people face financial stress. According to a recent Royal Bank of Canada (RBC) survey, many Canadians, especially young adults, have trouble sleeping due to money worries. The survey highlights the financial difficulties faced by Canadians of different ages and provides insight into their overall financial well-being.

Jump to

- Who were all surveyed?

- What does RBC suggest?

- When did the RBC conduct the survey?

- Why were the results revealing?

Who were all surveyed?

Credit: Financial Publishing

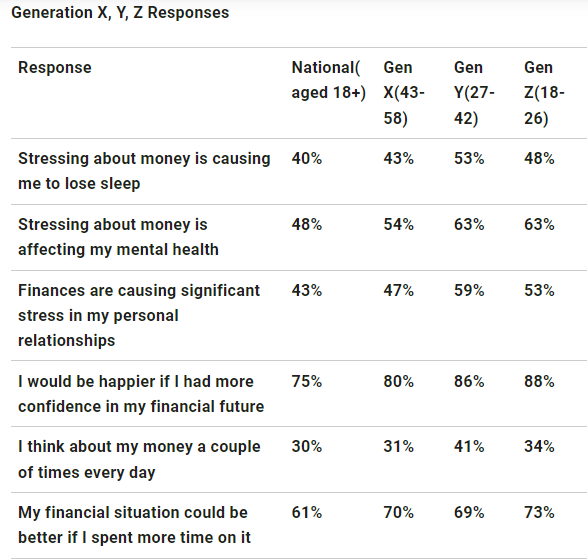

However, when millennials (defined in this study as those between 27 and 42 years old) alone contribute to the total, 53% of respondents report having trouble falling asleep, which is the largest percentage of any age group.

The Generation Z demographic, which spans ages 18 to 26, also reported a significant rate of sleep disruption (48%).

It was 43% among Generation X or those between 43 and 58 years old.

In fact, on a series of questions about financial stress, members of Generations X, Y, and Z consistently scored higher than the national average.

The younger the respondents were, the more anxious they were in many cases.

What does RBC suggest?

Credit: CTV News

Inflation affects Canadians of all ages, but a survey conducted on behalf of RBC suggests that younger people are disproportionately affected, at least in terms of their mental health.

As food bank use reaches an all-time high and more Canadians report going into debt to stay safe from the rising waves, it may not be a surprise that 40% of Canadian adults reported being taken out of debt. sleep due to monetary concerns.

When did the RBC conduct the survey?

RBC conducted the survey between July 27 and August 13, 2023.

Why were the results revealing?

Credit: GlobalNews

The results are based on 1,001 Canadians aged 18 and older who participated in RBC’s 2023 Canadian Financial Wellbeing Survey, conducted by Ipsos. Based on census data, the survey was weighted to represent the true demographics of Canadians.

Compared to the national average of 48%, 63% of Millennials and Zoomers reported that worrying about money was having a negative effect on their mental health.

Additionally, 54% of Gen Xers reported that their mental health has deteriorated.

When Canadians were asked about how financial stress had affected their personal relationships, similar results were obtained.

Compared to the national average of 43%, 59% of millennials and 53% of Generation Z reported having seriously damaged relationships as a result of financial difficulties.

Credit: GlobalNews

Following the 2008 recession, the Mental Health Commission of Canada released a report confirming that financial hardship and unemployment pose a significant risk of suicide and that rates of depression and anxiety increase during times of recession.

Of the 3,819 people surveyed, 39% said their mental health was being negatively affected by financial worries.

A staggering 41% of Canadians struggling financially admitted to having thought about taking their own life in the past year.

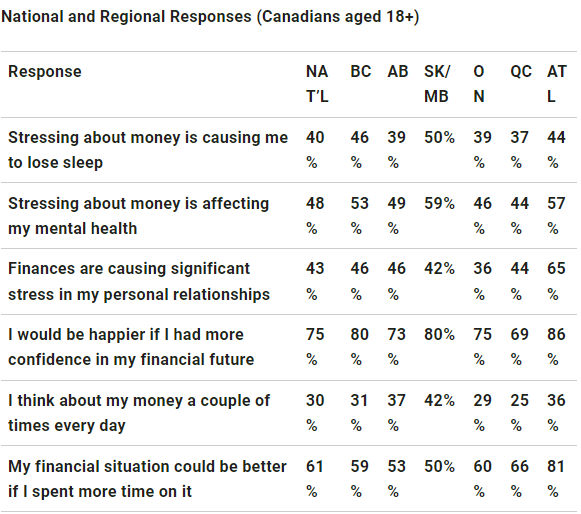

RBC research indicates that some Canadian provinces appear to be more affected than others by rising prices.

Compared to the national average, people in Western Canada and the Atlantic provinces consistently reported feeling more financially stressed, while people in Ontario and Quebec generally felt less worried.

what do you think about it? Let us know in the comments.

For more trending stories, follow us on Telegram.

Categories: Trending

Source: vtt.edu.vn