Creating and adhering to a monthly budget is essential to ensuring financial stability, and understanding how money comes in and out of your home is no less crucial, especially early in one’s financial life.

Having a solid foundation of support can help sustain any habit. The most effective budgeting tool is the one that’s convenient for you to use on a daily basis, whether it’s fancy software, a well-designed spreadsheet, or old-fashioned pencil and paper. Let’s explore our top picks to help you discover what best suits your preferences and helps you reach your financial goals.

1. mint

You can connect your bank accounts to Mint so you can generate a quote based on your past purchases. The software organizes your expenses into various buckets for things like food, utilities, and transportation. Although Mint automates everything for you, you have considerable control over your finances by changing default settings or adding new categories effortlessly.

Using Mint, you can easily save money for a variety of purposes. Mint will take your planned expenses and schedule into account once you’ve created a goal. In addition to being easy to use, Mint also provides several valuable insights. Things like your credit score, investments, and net worth are displayed alongside more conventional financial data, like income, expenses, and savings goals. The best part is that Mint is 100% free.

2. YNAB/You need a budget

Instead of reviewing past purchases, this software helps users prepare for the future. You can tell YNAB how much of each paycheck should go toward things like bills, savings, pension funds, and long-term plans, and it will automatically allocate the funds accordingly. You will be more deliberate when you are forced to choose how you spend your money.

YNAB requires a lot of user input because of all the options available. The YNAB website, which is where you can learn how to use the application, is full of instructional materials that will help you overcome the difficulty of learning how to use the software.

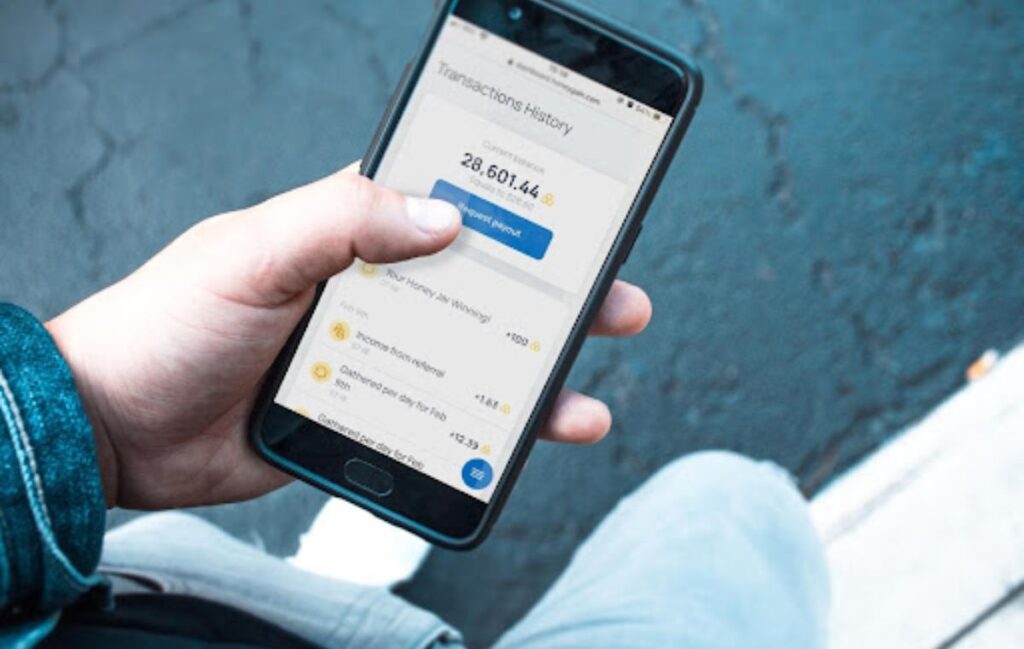

3. Honey Gain

Honeygain is another remarkable app to install on your device. The app is easy to set up and basically rewards you for letting you use your internet connection. You can earn anywhere from a few dollars to fifty dollars or more each month depending on how many devices you run the app on. It won’t eat up your processing power or slow down your internet.

Funds raised through Honeygain can be a great additional asset when it comes to saving some extra cash. Not bad, considering all you need to do is connect to Wi-Fi or mobile data, sit back, and let the app do all the work. A high speed internet connection is also not required.

4. Good budget

If you need help keeping track of your finances, you should also check out GoodBudget. It is cross-platform compatible, so you can try it on your Android, web browser, or iOS device. The data is synchronized between the different systems. You will also be able to monitor your expenses and income, as well as other useful budgeting features.

If you want to transfer your data to another device, you can export it with different file extensions such as CSV, OFX, and QFX. It’s simpler than most financial apps. However, the free version will limit your usage if you are not willing to pay a monthly subscription. The main disadvantage of GoodBudget is that you have to enter your transactions manually.

5. Honey

This app helps couples manage their finances together. The registration procedure for Honeydue is quick and painless: you simply register and send an invitation to your partner.

You can easily monitor your personal and joint budgets simultaneously. You can also restrict what your partner can see. You can share your balance or transaction history with the app after linking your bank account.

Bill reminders and in-app messages from Honeydue make it easy to stay on top of your monthly expenses and other financial commitments. Honeydue also offers a joint checking account with debit cards, perfect for those who want to pool their funds toward a shared goal.

Conclusion

Finding the best budgeting tool takes effort, but it’s definitely worth it. We suggest experimenting with a few options first and committing to the one that works best for you. Some people may prefer the Honeydue due to its couples-oriented design. In the meantime, having Honeygain installed can earn you additional funds to save for a bigger goal. Gaining better control of your finances will allow you to focus on other errands and enjoy your life more without unnecessary stress and worry.

Subscribe to our latest newsletter

To read our exclusive content, sign up now. $5/month, $50/year

Categories: Technology

Source: vtt.edu.vn